MarketWatch for November 2025

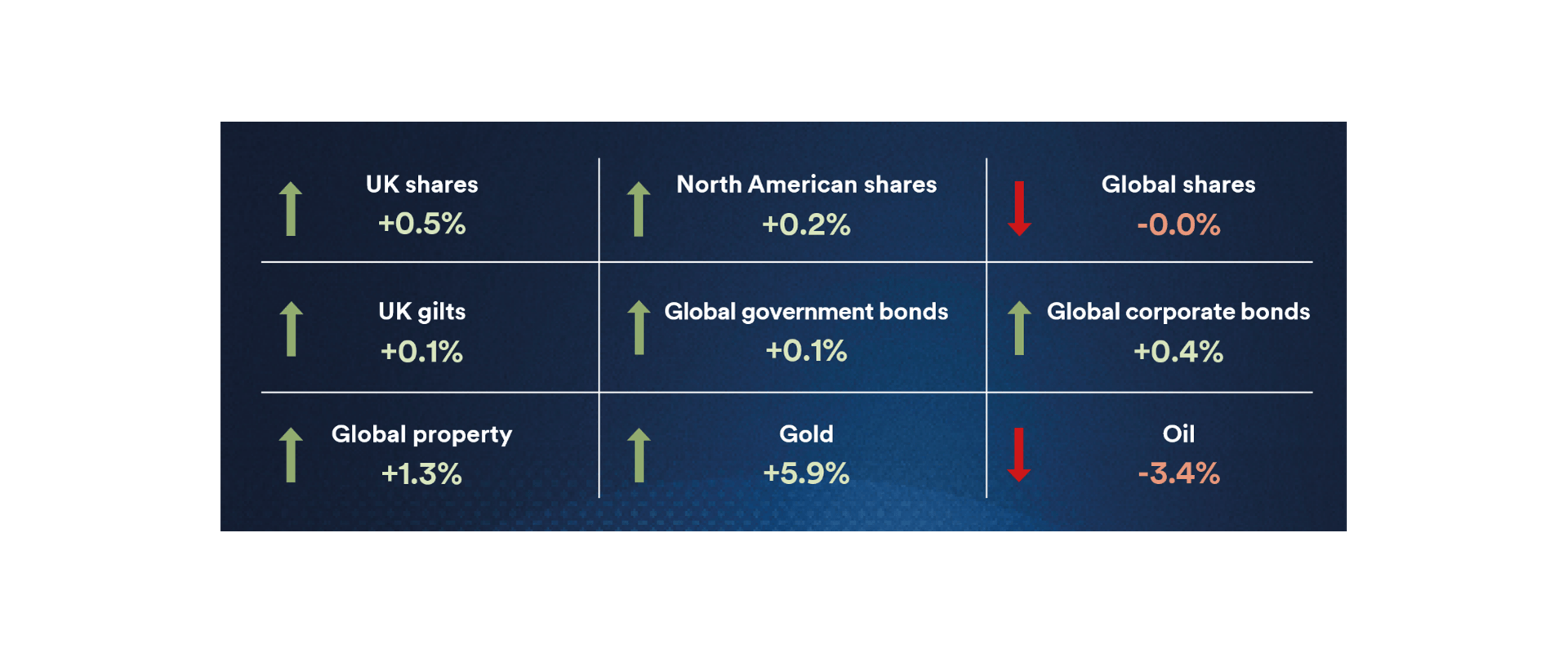

Markets were broadly steady in November as hopes for interest rate cuts grew. While US shares saw some volatility, particularly in technology and defence sectors.. UK equities benefited from falling gilt yields and a supportive Budget, while Japan and emerging markets delivered mixed results.

Global stock markets were broadly flat in November. Investors weighed falling bond yields against concerns over high valuations in technology and defence companies. Mixed economic signals due to the delay of data caused by the recent the US government shutdown also added to the uncertainty.

United States

US equities experienced heightened volatility in November. AI-related and defence stocks were particularly affected as investors reassessed earnings prospects and policy direction. While economic indicators such as jobs, inflation and confidence added to uncertainty, overall market performance remained steady. Growing expectations for a December rate cut supported sentiment later in the month.

Europe

Eurozone shares posted modest gains. Surveys suggested services activity was improving as the year-end approached, although manufacturing continues to face headwinds , especially in Germany. Investor sentiment was cautious but stable.

United Kingdom

UK shares advanced, helped by falling government bond yields and a weaker pound. Softer inflation and labour-market data saw 10-year gilt yield ease, reinforcing expectations of further Bank of England rate cuts. The Autumn Budget was well-received by the market, with extra fiscal room and lower expected gilt issuance supporting confidence. Energy-related sectors benefited from stronger commodity prices, while more domestically focused areas delivered quieter returns.

Japan

Japanese shares delivered mixed performance. The TOPIX index gained 1.42%, while the Nikkei 225 fell 4.12%, reflecting global concerns about valuations in AI and defence stocks and rising tensions between Japan and China, which weighed on sectors such as hotels and retailers. Solid earnings for the first half of the financial year helped support the broader market. The government announced a large fiscal stimulus package worth ¥21.3 trillion, which reinforced its supportive stance but raised questions about debt levels, weighing on Japanese government bonds.

Emerging Markets

Emerging market shares fell, giving back some of the strong gains seen earlier in 2025, despite a weaker US dollar and falling US Treasury yields.

Fixed Income

Government bond markets were steady overall, US Treasuries performed well as expectations for more rate cuts grew amid occasional risk-off sentiment. Corporate bonds had mixed results: US investment-grade and high-yield bonds performed more strongly than UK and European credit.

Commodities

Oil prices rose modestly, supporting energy-related shares. Precious metals such as gold delivered positive returns over the month.

Important information

Fees and charges apply.

The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment.

In preparing this article we have used third party sources which we believe to be true and accurate as at the date of writing but can give no assurances or warranty regarding the accuracy, currency or applicability of any of the contents in relation to specific situations and particular circumstances.

Any views expressed are our in-house views as at the time of publishing. This content may not be used, copied, quoted, circulated or otherwise disclosed (in whole or in part) without prior written content.