Navigating market declines: Stay Calm and seize opportunities

When markets take a dive, it’s hard not to feel the impact. Pensions, housing deposits, children’s savings, and clients’ investments all seem at risk. Even though we’ve seen market downturns before, each one feels different and uniquely challenging.

Crises are part of investing. Historically, the stock market drops by 20% about once every four years and by 10% most years*. It’s easy to forget this, and even seasoned investors find little comfort in these stats during tough times.

The stock market can potentially grow your wealth over the long term, but as with all investments your capital is at risk and short-term volatility and declines are part of the journey.

Think about this: despite recent losses, the global stock market has more than doubled your savings in the last five years (MSCI World index in USD terms). If you’d kept your money in cash, you’d only be up 14%. $10,000 invested in the stock market would be worth $20,700 today, compared to $11,400 in cash (1).

Staying objective and emotionally detached is incredibly tough. It’s easy to say “don’t worry,” but that’s not how most of us are wired.

What we can do is rely on data-driven analysis to help manage our emotional responses. Instead of reacting impulsively, we can make logical and reasoned decisions. For most investors, the best approach is to stay calm, stick to your plan, and look for opportunities in the volatility, however this will all depend on your individual circumstances.

Understanding market drops: A common occurrence

Frequent 10%+ Falls, 20% Drops Every Four Years

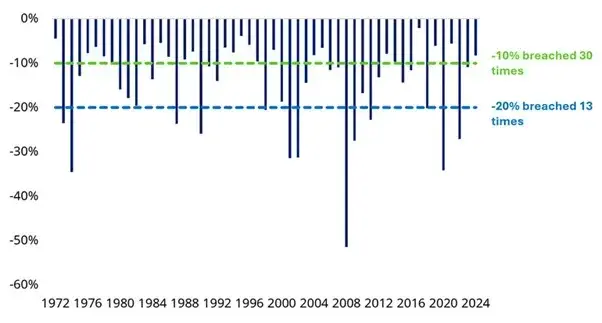

World stock markets, represented by the MSCI World Index, have seen 10% drops in 30 of the last 53 years. In the past decade, this includes 2015, 2016, 2018, 2020, 2022, and 2023. These drops are more common than you might think.

More significant 20% drops happened in 13 of those 53 years, averaging once every four years. If it happens this year, that will be four times in the past eight years: 2018, 2020, and 2022. These larger declines are less frequent but still part of the market's natural cycle.

Despite these regular bumps along the way, the US market has delivered strong average annual returns over this 53-year period. This shows that while short-term volatility is inevitable, long-term growth potential remains promising. It should be noted however that past performance is not a guide to future performance and may not be repeated.

*Source: LSEG DataStream, MSCI, and Schroders. Data to 31 December 2024 for MSCI World price index in USD terms.

Investing in stocks: Risky short-term, potentially rewarding long-term

Short-term risks vs. Long-term gains

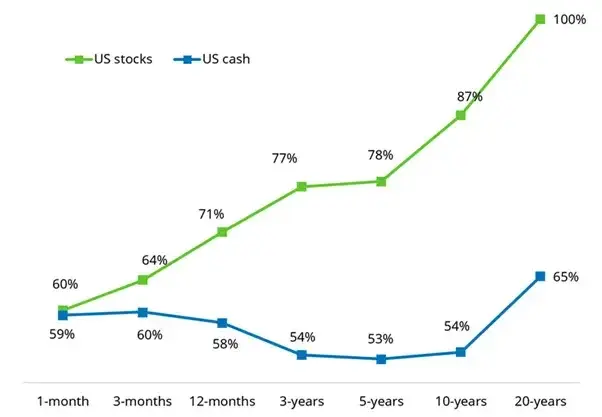

Investing in the stock market can be risky in the short run but less so in the long run. Using nearly 100 years of US stock market data, our investment partner Schroders have found that if you invested for a month, you would have beaten inflation 60% of the time but fallen short 40% of the time. This is similar to the success rate of cash investments.

However, if you invest for longer periods, the odds shift dramatically in your favour. Over 12 months, the stock market has beaten inflation 70% of the time. While 12 months is still considered short-term for the stock market, longer investment periods often show even better results.

On a five-year horizon, the success rate rises to nearly 80%. At 10 years, it approaches 90%. And there have been no 20-year periods in our analysis where stocks have failed to beat inflation.

Losing money over the long run is rare but not impossible.

In contrast, while cash may seem safer, it’s more likely to lose value due to inflation. The last time cash beat inflation over any five-year period was from February 2006 to February 2011, which feels like a distant memory now.

Source: Stocks represented by Ibbotson® SBBI® US Large-Cap Stocks, Cash by Ibbotson® US (30-day) Treasury Bills. Data to December 2024. Morningstar Direct, accessed via CFA institute and Schroders

Being spooked by volatility could cost you in the long run

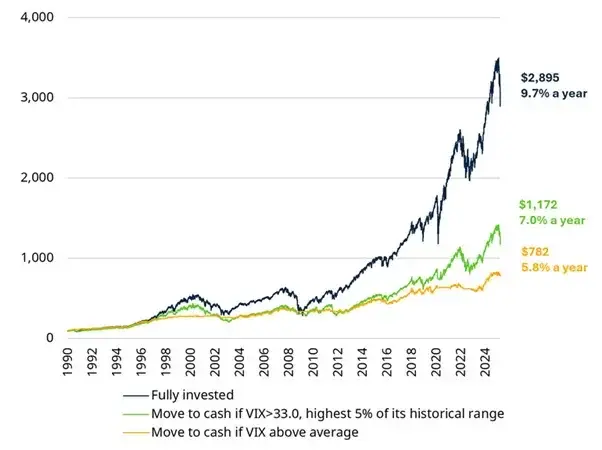

The US stock market’s “fear gauge”, the Vix index, has spiked in recent days. The Vix is a measure of the amount of volatility traders expect for the US S&P 500 index in the next 30 days. On Friday 4th April, it closed at a level of 45, well above the long-term average of 19.

However, history has shown us that investors would have lost out if they had sold during periods of heightened fear.

Schroders looked at a switching strategy, which sold out of stocks (S&P 500) and went into cash on a daily basis whenever the Vix was above 33, then shifted back into stocks whenever it dipped back below. 33 is a level where it has only been above 5% of the time, so it has been to represent a “high” reading.

This approach would have returned 7.0% a year (ignoring any costs), underperforming a strategy which remained continually invested in stocks, which would have returned 9.7% a year, again excluding costs.

If you are someone who gets nervous quickly and so would’ve been tempted to sell whenever the Vix goes above average, you’d have fared even worse.

Note: Levels in excess of 33.0 represent the top 5% of experience for the VIX. Portfolio is rebalanced on a daily basis depending on the level of the VIX at the previous close. Equity index is S&P 500, cash is 30-day cash. Data to 4 April 2025. Figures do not take account of any costs, including transaction costs. Source: CBOE, LSEG Datastream, Schroders

What to bear in mind now

Investing is personal, no two individuals or circumstances are identical. However, in many cases, the best response is to stay calm and stick to your plan. While the past isn’t always a guide to the future, history suggests that investors who react impulsively to market risks often lose out.

There’s always a reason to worry, but in the long run, stocks have outperformed bonds, which have outperformed cash. At SPW, we believe in the power of a well-diversified, global portfolio to navigate these ups and downs.

Opportunities ahead?

One silver lining for equity investors is that market declines mean your cash can now go further. Valuations have become more attractive, and for non-US markets, they are now cheaper compared to historical levels. Even the US market, which has long been an expensive outlier, is moving towards more neutral valuations.

This may present an opportunity. While there are more uncertainties than usual, for long-term investors with cash ready to invest, now might be the time to find some bargains. A policy shift could quickly boost markets, making this a potentially rewarding time to invest

Source:

(1) MSCI World Index

Important information

This article is for information purposes only. It is not intended as investment advice.

Fees and charges apply.

The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment.

Figures refer to the past and past performance is not a reliable indicator of future results.

Cash savings and investments are protected to the value of £85,000 per person per institution by the Financial Services Compensation Scheme (FSCS). However the value of investments may fall as well as rise.

Any views expressed are our in-house views at the time of publishing. This content may not be used, copied, quoted, circulated or otherwise disclosed (in whole or in part) without our prior written consent.

Please note that SPW is not responsible for the accuracy of the information contained within the linked site(s) accessible from this page.