Investing vs cash: Making your money work harder

When markets feel unsteady, it’s natural to wonder whether keeping your savings in cash might be the better option. Cash feels stable: it has a face value that doesn’t change day to day, which can offer a sense of certainty when investment performance is volatile. While holding cash might seem like the safer path in the short term, it carries a long-term risk that’s easy to overlook.

Inflation, explained

Perhaps the biggest risk to cash is inflation, meaning the gradual increase in the price of goods and services over time. You’ve likely heard about inflation in recent years, because in the post-Covid economy, it's been quite high. Inflation reduces the real value of money over time, meaning that the same amount of cash will buy you less in the future than it does today.

As a simplified example, imagine you’re given £50 today and find it just covers the cost of your food shop. If you’d chosen to hold onto that £50 for a year, though, you’d likely find it doesn’t stretch quite as far. While it might not be such a big deal for £50, on a larger scale, that inflationary effect can erode your cash savings quite significantly. If inflation is 4% a year, as it has been recently, £1,000 would be worth only about £960 in a year’s time in terms of what it can buy. After five years, that £1,000 would be worth around £820, and after 10 years, just £676.

When you leave money sitting in cash, especially over long periods, it’s exposed to this inflation erosion. Even as the cash amount stays the same, its purchasing power declines.

The power of higher returns

This inflation risk is a core part of the rationale behind investing. Investing means putting your money into assets such as stocks and bonds, which have the potential to generate returns – that is, profits from growth or income.

Investment returns aren’t guaranteed and can vary from year to year. Markets naturally go through periods of ups and downs, known as volatility. But over time, investing could offer significantly better returns than cash, helping your savings keep pace with or potentially even outstrip inflation.

Of course, market volatility can be unsettling and it’s completely normal to feel uncertain when markets dip. But reacting by pulling out of your investments – or starting to hoard cash instead – can mean locking in losses and missing the chance to benefit from a recovery.

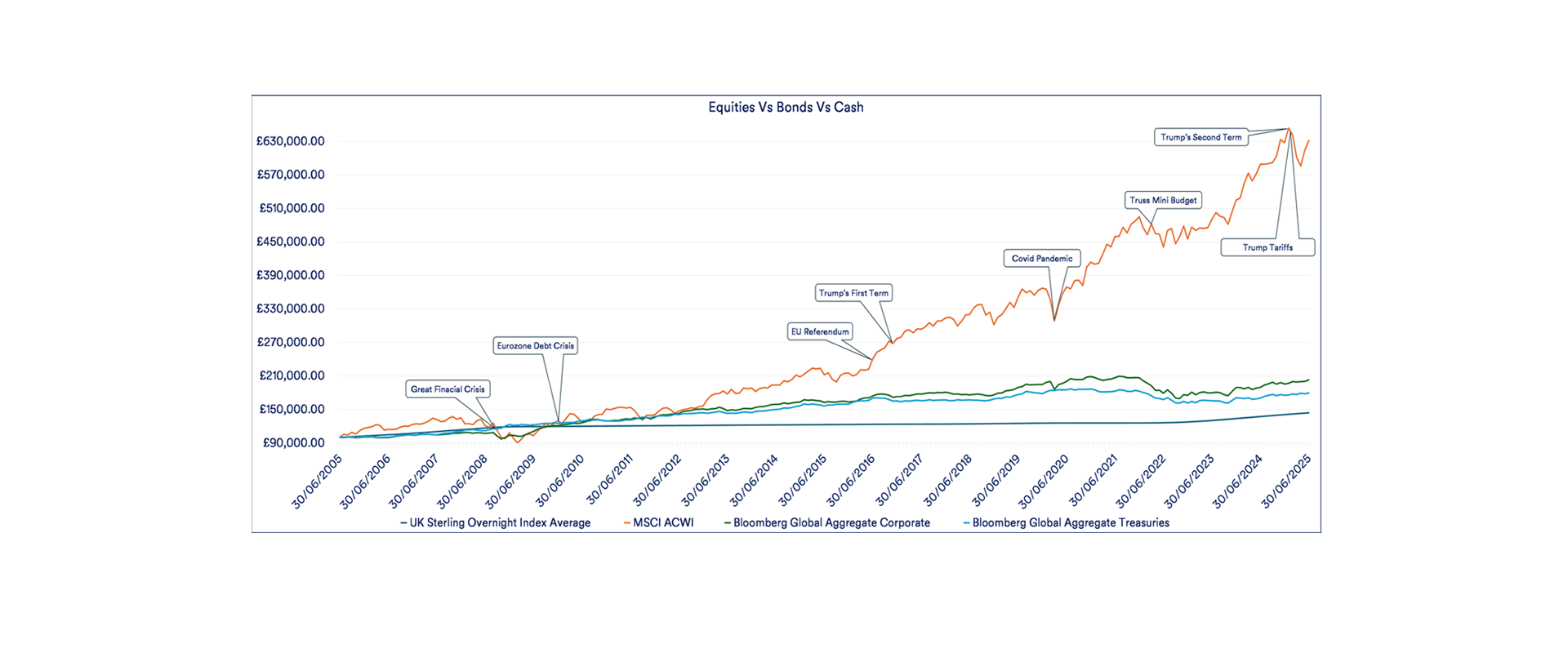

History shows that markets tend to be resilient over time. This is the logic behind our mantra: time in the market is better than timing the market. The below graph shows the returns on shares (equities) compared to cash over the past 20 years. While you can see that equity returns move up and down quite often, the general trend is up, far outstripping cash over time.

How you can enhance your investment returns

One of the most powerful benefits of long-term investing is compound returns. This means that any gains you make are reinvested, allowing your returns to start earning returns themselves. Over time, this compounding effect could potentially significantly increase the value of your savings.

To make the most of this, it’s important to invest in a tax-efficient way. The UK government recognises that investing is good for both people and the domestic economy, which is why it offers incentives for investors. For example:

- Pensions: A pension is a kind of investment portfolio that’s designed to grow your retirement savings over time. The government wants people to save for their retirements, so it applies certain tax benefits to pensions to help encourage it.

- Stocks and Shares ISAs: Similar to pensions, the government offers tax incentives if you invest in an Individual Savings Account (ISA) currently up to £20,000 per year. These benefits vary depending on the account type but can be attractive depending on your goals.

By combining compound growth with tax-efficient wrappers like pensions and ISAs, you could potentially significantly enhance your investment outcomes over time.

The case for (a small amount of) cash

It’s important to note that some investments are riskier than others. We probably wouldn’t recommend that you invest all your savings in emerging markets in far-flung corners of the globe, for example. However, we believe a small amount of measured risk-taking in tried-and-tested markets could prove beneficial over the long term.

Of course, cash does still play a role in your finances. It’s useful for covering the cost of day-to-day living and a moderate rainy-day fund can be critical to help soften the blow of emergency expenses. That said, relying too heavily on cash as a long-term strategy may mean missing out on growth.

We hope this article is useful to explain the roles of cash versus invested savings. Our team often produces educational content to help you feel more comfortable and confident in the world of finance. For example, you can peruse our beginner's guide to investing, learn about how psychology affects financial decision-making, or read up on a whole host of other interesting topics that impact your money.

We also offer personalised financial advice through our sister organisation, Schroders Personal Wealth, should you feel like you need it.

Important information

This article is for information purposes only. It is not intended as investment advice.

Fees and charges may apply at Schroders Personal Wealth.

The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment.

Cash savings and investments are protected to the value of £85,000 per person per institution by the Financial Services Compensation Scheme (FSCS). However, the value of investments may fall as well as rise.

Schroders Personal Wealth (ACD) is a trading name for Scottish Widows Schroder Personal Wealth (ACD) Limited. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 11722983. Authorised and regulated by the Financial Conduct Authority under number 834833.