How can divorce affect women's financial wellbeing?

Women can be disproportionately affected by divorce. But there are steps to take to ensure you get your fair share and don’t face unnecessary stress.

- As well as the emotional effects, divorce can have a big financial impact, especially on women.

- It’s important to make the effort to reach a fair and considered settlement for everyone’s peace of mind, especially when it comes to pensions.

- Good advice during and after your divorce can help ensure your retirement income isn’t blown off course.

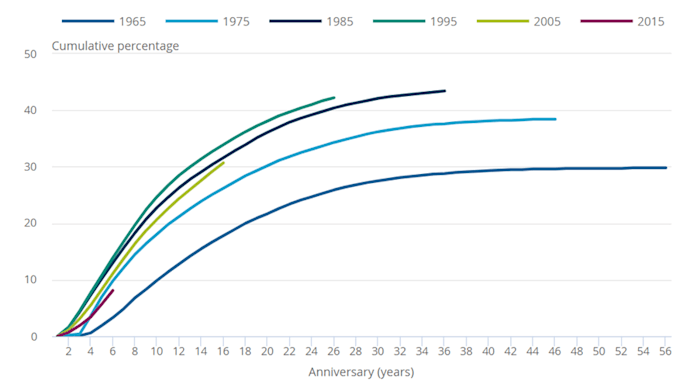

Recent divorce data may surprise many of us. It reveals that 41 percent of marriages that took place in 1996 had ended in divorce by their 25th anniversary. In contrast, a relatively small 23 percent of marriages that took place in 1963 had ended in divorce by their 25th anniversary (1).

Even so, as the chart below shows, couples married in 2005 and 2015 are showing lower divorce rates than couples from some earlier time periods.

Percentage of marriages ending in divorce by years of marriage and anniversary

The sad fact is divorce can be devastating, not just on your emotional and mental wellbeing, but also on your finances. Divorcees often see significant falls in household income following separation. But women are hit particularly hard, experiencing a 33 percent decline in income, compared with 18 percent for men (2).

Divorce is getting easier

The Divorce, Dissolution and Separation Act 2020 came into force on 6 April 2022 (3). This aims to make it easier for couples to divorce. It removes two historical issues.

According to a Ministry of Justice report, it removes the requirement for one party to be shown to be at fault, paving the way for ‘no-blame’ divorces (4).

It will also no longer be possible for one of the parties to contest a divorce brought on the grounds of irreconcilable differences. As the Justice department puts it: ‘Marriages are not saved by the ability of one spouse to “contest” a divorce in court. Very few divorces are contested but this practice is known to be misused by abusers choosing to contest a divorce purely to continue their coercive and controlling behaviour.’ (4)

Preparing to divorce

If divorce is the inevitable outcome, then you could benefit from preparing as much as possible for this big step. In an ideal world, divorcing spouses would sit down to divide their assets, and work out who will pay for what going forward calmly and fairly. If you can reach amicable agreements that work well for both of you, these can be made into an official Consent Order which commits both of you to carrying these arrangements out (5).

However, if it’s too difficult to negotiate how to divide up what you own between you, and how you will share income or assets in the future, then mediation could be an option. A divorce mediator doesn’t take sides but aims to provide a neutral service to help you negotiate agreements you can both live with (5).

If neither of these strategies is right for you, a professional divorce lawyer can be brought in to help you organise your divorce settlement and, if necessary, you can go to court for a judge to decide. But turning to a divorce lawyer needn’t be the first recourse (5).

A fair outcome

It’s important to negotiate thoroughly and carefully. This could mean both parties come out of a divorce believing reasonable agreements have been made about the family home, other savings or assets, and the payment of any maintenance. Resentment and further disagreements could otherwise be reignited in the years ahead, especially if new partners come on to the scene.

So, it’s important to get a fair settlement and to consider how you will look after yourself in the years ahead.

Dividing all the assets, including pensions

When you leave a marriage, especially one that you’ve been in for a long time, you need to ensure that you receive your fair share of all the assets. This includes the visible ones – such as the house, the cars, the paintings – and also the less visible, but nevertheless important ones, including savings accounts, investments and pensions.

As found in the 2023 Department for Work and Pensions report ‘The Gender Pensions Gap in Private Pensions’, women have 35 percent less in private pensions savings than men. And the gap widens to 47 percent for people aged between 45 and 49.

According to the Money Helper website, to get the full State Pension, you need to have made qualifying National Insurance (NI) payments for a minimum of 35 years. To qualify for any State Pension you need at least 10 years’ NI credits. This is usually from full-time employment but some working age benefits will give you NI credits including Child Benefit. So make sure you’re claiming all that you should.

It’s hugely important for your future financial wellbeing that you claim your fair share of your spouse’s future pensions, both state and private. So, make sure you discuss pensions when dividing your assets.

It’s also a good idea to get legal advice on how best to allocate pensions savings. This can help you work out if the pensions savings have been allocated in a fair way. Katie Nutting, Financial Planning Director at Schroders Personal Wealth (SPW), said: ‘Without such advice, you could be putting yourself in a vulnerable position when it comes to later life retirement planning.’

It is also important to arrange a financial separation via a Consent Order. Sometimes people who don’t make such an arrangement go on to make substantial sums of money and find their ex spouses make a claim on this new wealth. The Consent Order needs to be approved by a court to be legally binding.

A top tip from Unbiased.co.uk: once you are divorced, you might no longer want to leave your pension to your ex on your death. If this is the case, you need to change the name of the ‘beneficiary’ or ‘beneficiaries’ registered with your pension provider (6). Your pension savings are not regarded as part of your estate and are not therefore covered by your will.

In a similar vein, you might also want to change the beneficiaries on any life cover you may have. And people who are receiving maintenance payments might want to consider taking life cover on the person making the payments, as this could provide an income should their ex develop a critical illness or die. Maintenance payments could cease in these circumstances.

The marital home

It’s worth giving careful thought as to whether or not to keep the marital home. It can be tempting to hang on to this to give the children some stability during a time of change. But, as the Money Helper website points out, this could mean the remaining partner having to buy out the one leaving the house, or giving up some other financial benefits (7).

This, in turn, could include missing out on a share of your partner’s pension or higher maintenance payments. So consider carefully if it really makes sense to run a bigger home than you need, and on one income instead of two.

You could also consider keeping the marital home in joint ownership until the children are ready to leave. But will your ex – who no longer lives in the house – want to pay for roof repairs or new carpets when they may have another property of their own to look after? It can also prevent you from taking out a loan or mortgage on the property.

It may be the best idea to sell up, split the proceeds as appropriate, and downsize to new properties that make better financial sense and represent a fresh start.

The impact on stay-at-home parents

In 2020 the Chartered Institute of Insurers (CII) published a wide-ranging report on women’s risks in life (8). It highlighted how women today still take on most of the caring responsibilities for children and other family members. They also take on the greater share of housework.

Moreover, women are far more likely to leave paid employment, losing earnings and pension savings as a result. ‘Consequently, many women remain dependent on their partners, with potentially significant financial implications if money matters are not fully discussed and planned jointly,’ said the report.

The report also highlighted how divorce can have significant financial impacts on women. ‘At this time in their lives many women experience financial difficulties in the divorce and separation process. With a significant majority of lone parent families headed by women [divorce] makes re-starting rewarding work post break up challenging for many, especially for those who have curbed their career for family caring.’

Planning your own financial future

The first years after a divorce can be very difficult, both emotionally and financially. You could have to pay for everything yourself, from the car to the mortgage, to the wi-fi, to the insurance policies and all the other bills and expenses that come with running a household. A lot of these costs are the same whether two of you are paying for them or one. And when one household becomes two they can effectively double.

The CII report highlights what it calls the ‘Women’s wellness threat’, stressing how ‘many women have little or no independent savings’, which can leave them vulnerable. But if you’re about to take charge of your new life, it’s definitely time to take charge of your finances, both in the short and the long term.

Take quality financial advice that’s just for you, and maybe your children too. You may have your own pension, ISAs, life insurance and protection to think about, so there could be lots to sort out and talk over. Hopefully, taking control of your money, and building a financial plan can help you face the future with confidence. At SPW, one of our principles is to have regular reviews with a financial adviser.

Can divorce ever bring good news?

Yes, according to academic research from Kingston University (9). The study surveyed 10,000 people in the UK over two decades. It showed that women are ‘significantly more content’ than usual for up to five years following the end of their marriages.

So, although divorce can be a traumatic and difficult life event, with good planning, preparation and a positive mindset, it can also become a wonderful new beginning.

Sources

(1) Office for National Statistics, ‘Divorces in England and Wales: 2021’, 2 November 2022.

(2) Legal & General, ‘The Divorce Gap – women see incomes fall by 33% following divorce, compared to just 18% for men’, 4 January 2021.

(3) Gov.uk, ‘New divorce laws will come into force from 6 April 2022’, 8 March 2022.

(4) Gov.uk, ‘New divorce law to end the blame game’, 9 April 2019.

(5) Gov.uk, ‘Money and property when you divorce or separate’, 19 July 2023.

(6) Unbiased.co.uk, ‘How your ex might still inherit your pension’, 20 December 2022.

(7) Moneyhelper.org.uk, ‘Dividing the family home and mortgage during divorce or dissolution’, 20 July 2023.

(8) Chartered Insurance Institute, ‘Insuring Women’s Futures’ Manifesto: The full report’, January 2020.

(9) Kingston.ac.uk, ‘Research shows divorce spells big boost to women’s happiness’, 8 July 2013.

Important information

Fees and charges apply at Schroders Personal Wealth.

The different scenarios discussed are examples and what is right for each person will depend on individual circumstances.

The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment.

The retirement benefits you receive from your pension plan depend on a number of factors including the value of your plan when you decide to take your benefits which isn't guaranteed and can do down as well as up. The benefits of your plan could fall below the amount(s) paid in.

There is no guarantee by investing money it will keep level or beat inflation, particularly when inflation is high.

Any views expressed are our in-house views as at the time of publishing.

This content may not be used, copied, quoted, circulated, or otherwise disclosed (in whole or part) without our prior written consent.

In preparing this article we may have used third party sources which we believe to be true and accurate as at the date of writing. However, we can give no assurances or warranty regarding the accuracy, currency or applicability of any of the content in relation to specific situations and particular circumstances.

Protection policies have no cash-in value at any time. If you don’t pay your premiums on time your cover will stop, your benefits will end, and you’ll get nothing back. If the benefit amount has not been paid out by the end of the selected term, the policy will end and you’ll get nothing back.